October 27, 2025

𝗧𝗵𝗲 𝗗𝗲𝗳𝗶𝗻𝗶𝘁𝗶𝘃𝗲 𝗘𝘂𝗿𝗼𝗽𝗲𝗮𝗻 𝗩𝗖 𝗥𝗮𝗻𝗸𝗶𝗻𝗴?

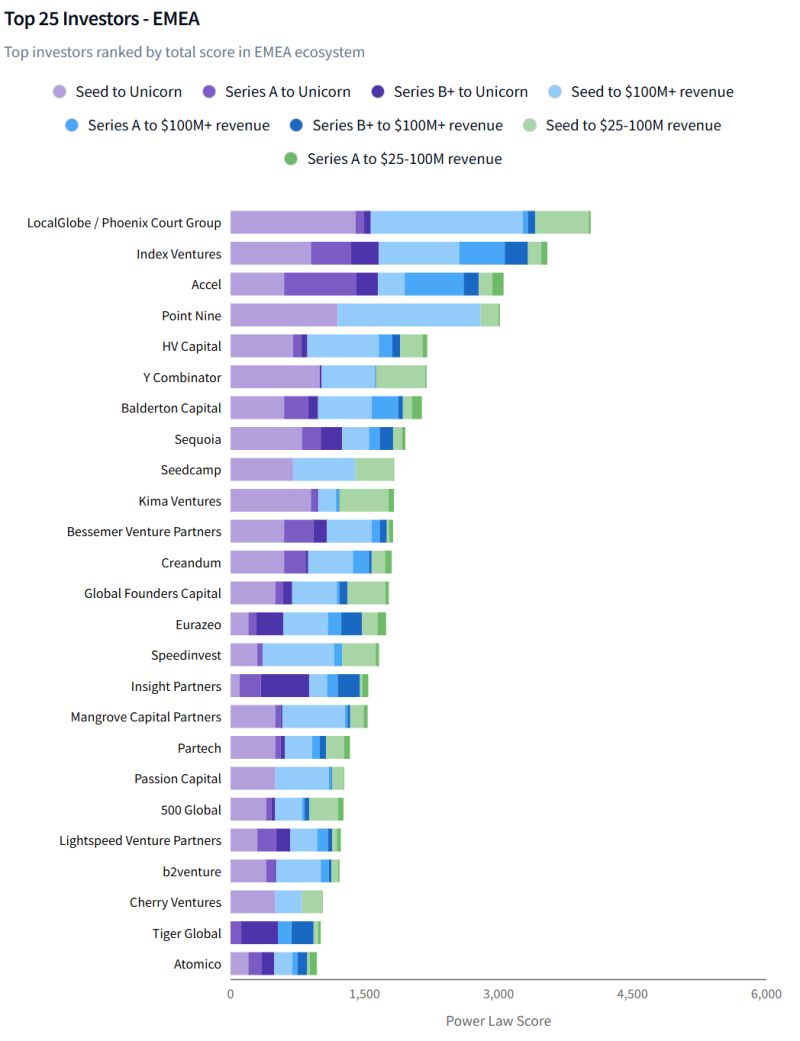

In the quiet of summer, DealRoom published a list of Top 25 European investors.

Like all lists we have to take it with a pinch of salt. This one is compiled using a score based on 2/3 linked to revenue milestones and 1/3 (only) to valuation-based outcomes. So premium to ARR and SaaS business models.

This is however an opportunity to ponder on the factors which make an investor right for you (in no particular order):

✔️𝗦𝘁𝗮𝗴𝗲 𝗥𝗲𝗹𝗲𝘃𝗮𝗻𝗰𝗲 – Most stats mix early and late-stage investors and anything in between. Stage matters, and relevant investors will be different depending on where you are on your journey.

✔️𝗕𝗿𝗮𝗻𝗱 𝗲𝗾𝘂𝗶𝘁𝘆 - Success begets success. In short, who you take on board will largely define your range of possible outcomes. So, the right name is just as important as the valuation of a given round. The ability to drive to exit if what you need to worry about.

✔️𝗦𝘆𝗻𝗱𝗶𝗰𝗮𝘁𝗶𝗼𝗻 𝘃𝗮𝗹𝘂𝗲 – Investors work in packs. A lead investor will bring other investors, that’s what being “lead” means. Behind these relationships lie a level of ambition (get ready for the ride) and a way to operate (local vs international, passive vs. proactive etc). So, make sure you have an explicit discussion re what you (together) want to build.

✔️𝗜𝗻𝘁𝗲𝗿𝗻𝗮𝘁𝗶𝗼𝗻𝗮𝗹 𝗿𝗲𝗮𝗰𝗵 – The limited overlap between the Top 25 European and Global/US investors show that capital markets are still fragmented, but the best investors are probably also global.

Among the very best (excluding seed investors): Accel, Index Ventures, Lightspeed, LocalGlobe, Point Nine, Sequoia Capital, Tiger Global.

✔️𝗦𝗮𝗮𝘀 𝘃𝘀 𝗗𝗲𝗲𝗽𝘁𝗲𝗰𝗵 – Many investors have done well out of Annual Recurring Revenues (ARR) businesses. When it comes to Deeptech, there is no such things. In fact, many deeptech businesses can take years to revenue generation. As SaaS comes under pressure from AI and usage-based business models, many SaaS investors are turning to Deeptech. This does not mean they really want do it or they can do it competently.

It is also an occasion to remind ourselves:

👉 𝗟𝗲𝗮𝗱 𝘃𝘀 𝗖𝗹𝘂𝗯 𝗱𝗲𝗮𝗹𝘀 – The VC game is shaped by lead investors who champion the investment. More often than not, Deeptech investments are just too big for any one investor to take >20%. Moreover, the technology risks are just too big. So many deeptech investments end as “club deals”.

👉 𝗡𝗼𝗻-𝗘𝘅𝗲𝗰𝘂𝘁𝗶𝘃𝗲 𝗗𝗶𝗿𝗲𝗰𝘁𝗼𝗿𝘀 (𝗡𝗘𝗗𝘀) – Too many companies are slow at hiring NEDs – this is just not the priority once the money is in. Or management and investors cannot agree. Selecting NEDs is a great to define the board culture (strategic vs micromanagement) and governance (do investors welcome the independence of the NEDs?).

📎 Source:

https://dealroom.co/power-law-investor-ranking